By William Buck Director of Tax Services Jack Qi and Manager Alex Zinzopoulos

‘Go-global’ is one of the most oft-repeated mantras in the Australian tech sector – and for good reason. To realise the true potential of a startup or scaleup tech company, going global is practically expected by its stakeholders.

When a company wishes to launch its go-global strategy, one of the most topical issues is the concept of a “flip-up”. Whilst this is a commonly-discussed concept, myths and misconceptions abound.

What is a flip-up?

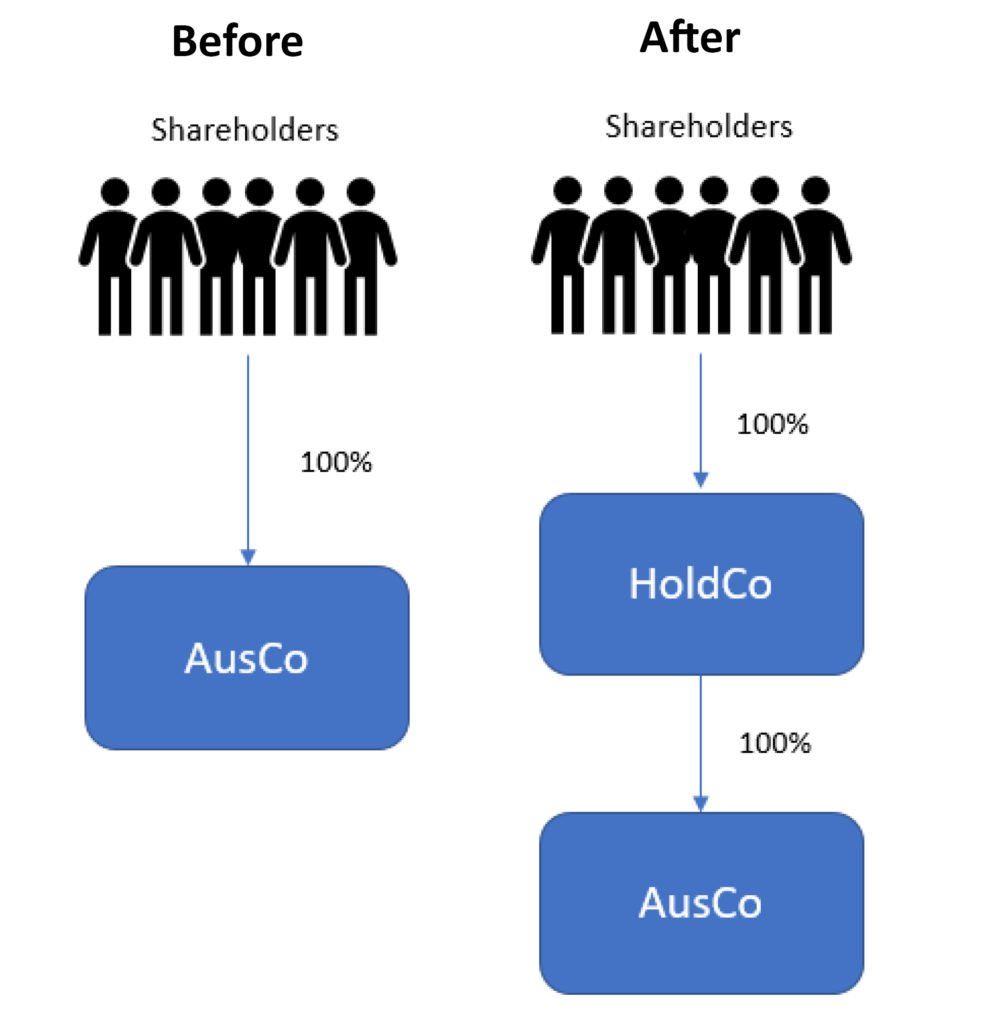

Put simply, a flip-up involves interposing a company (“HoldCo”) between the original company and its shareholders. HoldCo would be incorporated in the foreign jurisdiction of choice, be it the U.S., U.K., Singapore, China, Hong Kong or some other jurisdiction. Usually, but not necessarily, HoldCo is a newly incorporated shell company.

Legally speaking, the shareholders are exchanging their shares in the original company for shares in HoldCo, which will become the 100 per cent parent of the original company. The original shareholders still maintain an interest in the original company, although now the interest is an indirect one.

After the flip-up, it can be said that the business’s head company is now located overseas.

Pros of a flip-up

Generally, a flip-up is an integral part of the go-global strategy of a startup/scaleup by potentially providing the following benefits:

- Access to a broader pool of overseas investors, who may be more willing to invest in a company in their own jurisdiction as opposed to a foreign one;

- By having its headquarters in the jurisdiction of choice, it can relocate some or all of its senior management there to more effectively drive overseas expansion; and

- Access to overseas markets and employees (although the same can be achieved by merely establishing a subsidiary company in that country – see below).

Cons of a flip-up

However, a flip-up is not the answer for every company:

- A flip-up is a ‘hard egg to unscramble’, meaning that once completed, it is generally difficult to unwind due to complex tax hurdles and the usual commercial and legal difficulties associated with changing the business headquarters yet again;

- With a flip-up comes the complexity of having an international structure – as shown in figure one – with higher compliance obligations but also costs. This will result in needing to find and appoint lawyers, accountants, advisors and other good trusted people in the new jurisdiction to navigate the business through new commercial and cultural intricacies; and

- If the company reaches profitability (before it is acquired, of course!) and wishes to pay a dividend, such dividends from the foreign HoldCo to its Australian shareholders will not have franking credits attached, which would ultimately increase the overall tax rate on profits from the business for Australian shareholders.

Our advice to startups and scaleups we work with is that “commerciality and timing is key”. Flipping up too early increases the risk of making the wrong call as to whether the chosen overseas destination is in fact the right one, or whether the prospective overseas investor is actually serious about investing. Leaving it till too late could mean missed equity funding and market opportunities

Ultimately, there must be strong commercial reasons for doing business overseas – tax is rarely a critical driver. Due to the complexity, a company should only do a flip-up once it’s sure that it has carefully considered all relevant issues and sought the appropriate advice.

Alternatives to a flip-up

If the stated purpose of a flip-up is to attract overseas investors, a question that should be asked is whether the investor can be persuaded to simply invest in the existing Australian company. Where the main driving force is to access overseas markets, the same benefits may be accessed via establishing an overseas subsidiary company, which involves significantly lower cost and complexity.

Does a flip-up allow a tax-free exit for shareholders?

This is one of the most common misconceptions – people often mistakenly believe that just because they own shares in a company based overseas, they no longer need to pay Australian tax in the event of a successful sale or exit. In reality, a flip-up is unlikely to change the general starting position for most Australian resident taxpayers that a disposal of their investment will likely attract Australian income tax consequences. As always, personalised tax advice should be sought prior to any material transaction.

Other considerations

By becoming a cross-border business you will now need to consider a range of additional financial and tax issues, including but not limited to:

- Location of current and future IP, including how this affects the Australian R&D tax incentive;

- Impact on existing employee share schemes – how to unwind and replace existing schemes tax-effectively whilst maintaining alignment between company and employee interests;

- Impact on convertible notes and other debt financing;

- Double tax agreements;

- Foreign taxes and potentially complex disclosure requirements in foreign jurisdictions (e.g. U.S.);

- Profit repatriation strategies;

- Transfer pricing/intragroup transactions;

- Tax residency of companies in the group and their executives;

- Thin capitalisation rules;

- Accounting implications – how to correctly reflect the flip-up in the financial statements of the new holding company; and

- Protection of Australians who become Directors of the foreign company.

Getting it done – the process of doing a flip-up

Once the relevant considerations have been undertaken and a startup or scaleup is leaning towards pressing the “Go” button, it is time to seek the appropriate advice.

In a flip-up, the shareholders of the original company are exchanging their shares for shares in HoldCo, which will become the 100% parent of the original company. A flip-up is a project whose commercial, legal and importantly, tax issues must be managed effectively. Generally speaking for an Australian company, the Capital Gains Tax implications for its Australian shareholders will need to be mitigated by accessing the appropriate tax rollover, which, if available, could defer the CGT consequences arising as a result of them disposing of their interest in the original company. Such tax rollovers have specific eligibility requirements, thereby necessitating an experienced tax advisor to drive many of the restructure steps. In addition, an experienced legal team needs to be appointed in both Australia and overseas.

If you have any questions on how to go-global with a flip-up, or if you are wondering if a flip-up is right for your company, contact one of our experienced advisors.

To find out more contact: Tax Services Director Jack Qi and Manager Alex Zinzopoulos